If you’ve been following the stock market recently, you may have noticed some unsettling new trends. The S&P 500 experienced a notable pullback, losing about 6% over a three-day trading period late last week and early this week. While sharp declines like this are never pleasant, this instance seemed to garner extra attention. Prior to this drop, the S&P 500 had gone an impressive 356 sessions without a 2% decline, a streak not seen since 2007. Additionally, the index set 38 closing records this year, amplifying the impact of the recent pullback.

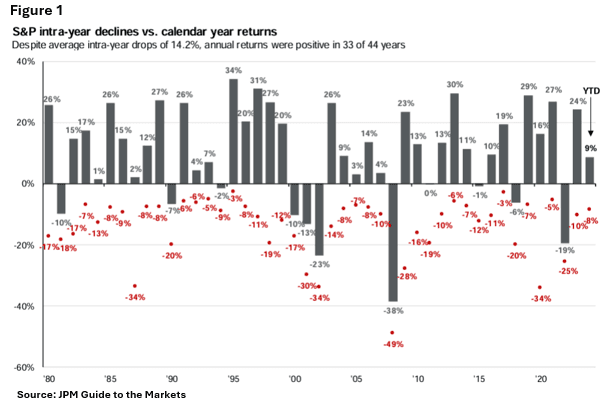

So, is this kind of intra-year decline typical? Actually, yes. The chart below (see Figure 1) reveals that the average intra-year drop is around 14%. Therefore, while the S&P 500’s 8.5% pullback over the past few weeks may seem significant, it falls within the range of normal market fluctuations. Given the recent streak of stability, however, it may feel more jarring than unusual.

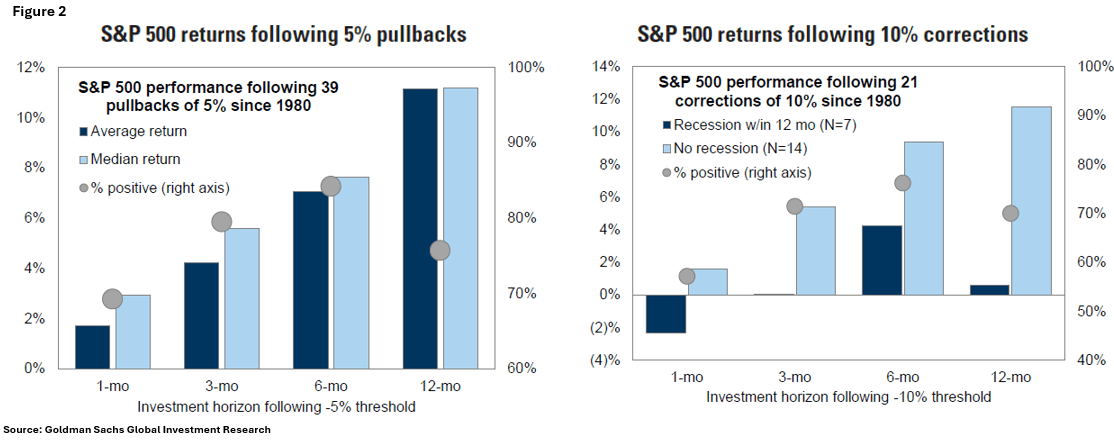

Looking ahead, investors might wonder, “What’s next?” According to the charts in Figure 2, historical data suggests that after corrections of 5% and 10%, market returns tend to be quite positive over both the short and long-term.

In times like these, it’s crucial to stay focused on your long-term goals. Now is an excellent opportunity to review your investment strategy and consider rebalancing your portfolio. If you’re unsure where to start or need personalized advice, don’t hesitate to reach out. Our team of advisors is here to help you navigate these market fluctuations and make informed decisions tailored to your specific financial goals. Contact us today to schedule a consultation and ensure your investment strategy is on track for success.

Our wealth management advisors can help you with our comprehensive suite of services designed to help you achieve your financial goals. Contact us today and let's start building your financial future.