On January 30th and 31st, all eyes turn to the Federal Open Market Committee (the FOMC) as they kick off the first of their eight scheduled policy meetings for 2024. The FOMC meeting involves a comprehensive review of current economic and financial conditions, an assessment of risks to their long-term goals, and the determination of an appropriate monetary policy stance.

Understanding the FOMC Meeting:

During the meeting, often referred to simply as “the Fed,” officials carefully examine economic indicators, evaluate financial landscapes, and deliberate on the risks posed to price stability and sustainable economic growth. The outcome of this scrutiny is a decision on the Federal funds rate – the interest rate at which banks lend to each other overnight. This rate, in turn, influences the broader credit markets and has a ripple effect on various sectors of the economy.

Monetary Policy Decisions:

The FOMC’s decision on the Federal funds rate is not taken lightly. Depending on their assessment of financial, economic, and monetary conditions, committee members may vote to increase, decrease, or maintain the rate. This decision, though seemingly straight forward, plays a pivotal role in shaping the short-term landscape of credit markets.

Impact on Credit Markets:

The implications for credit markets are relatively clear-cut. When the Federal funds rate is adjusted, interest rates in the broader credit market respond accordingly. A rate hike can lead to increased borrowing costs, while a rate cut may stimulate borrowing and spending. The outcome is felt swiftly and directly, making it a key focus for market participants and investors.

The Unpredictable Impact on Stock Markets:

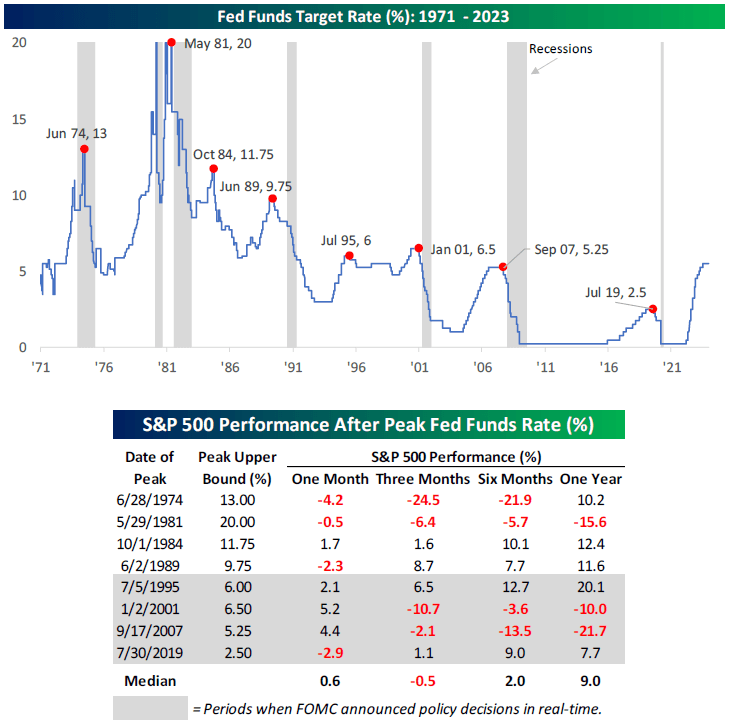

In contrast, the impact on the stock market is less predictable. The accompany chart illustrates historical periods when the Fed funds rate has peaked, signaling a subsequent decrease. Notably, these instances often precede economic recessions, as indicated by the grey shaded columns.

An Interesting Phenomenon:

However, its essential to note an intriguing phenomenon: while a recession typically follows a peak in the Fed funds cycle, the stock market, as represented by the S&P 500, tends to exhibit resilience. On average, the S&P 500 has produced a 9% return in the year following the peak Fed funds rate. This suggests that while economic challenges may lie ahead, the stock market has demonstrated a capacity to weather the storm and even thrive in the aftermath.

Conclusion:

As we approach the FOMC’s inaugural meeting for 2024, investors and market enthusiasts brace for potential shifts in monetary policy that could reverberate through credit and stock markets alike. While the impact on credit markets is relatively straightforward, the stock market’s response remains an intriguing and sometimes counterintuitive dynamic. Understanding these nuances is essential for navigating the financial waters and making informed investment decisions in the face of changing economic tides.

Our wealth management advisors can help you with our comprehensive suite of services designed to help you achieve your financial goals. Contact us today and let's start building your financial future.